Wish You a Very Happy New Year. I Wish for Great Trading This Year,

This Year Bring You Lots of Love & Happy in Your Life. So Keep Trading With Happy !!!!

This Year Bring You Lots of Love & Happy in Your Life. So Keep Trading With Happy !!!!

Nifty Future Tomorrow - 3 Jan

Nifty Future

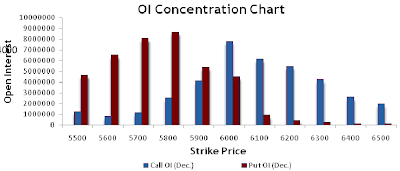

Nifty future saw healthy recovery and closed near to its resistance levels. As we previously mentioned that if it sustains above 6100 level it can take more up move. We can see some more up moves till 6250 level, one should adopt the strategy of buy on dips. Resistance for Nifty future is at 6215/6320 and support is at 6100/6062 levels.

SunTv, Wipro Gail Would be Bullish for Monday

RESISTANCE: It has first resistance close to the level of 6215 & above this level the next resistance is seen near the 6320 mark.

SUPPORT: It has first support close to the level of 6100 & below this level the next support is seen near 6062 mark.

Bank Nifty

RESISTANCE: It has first resistance close to the level of 11927 & above this level the next resistance is seen near the 12050 mark.

SUPPORT: It has first support close to the level of 11680 & below this level the next support is seen near 11575 mark.